How to Negotiate Your Salary in 2021

There are generally two opportunities to influence how much money you make: when you get a new job and when you ask for a raise in an existing job. Money is usually the most sensitive issue in the hiring process. Discussing compensation often causes anxiety for both employee and employer. Negotiating an initial salary can be stressful; it doesn’t get any easier once you have the job and want a raise.

Confidence is important in negotiations. You’ve probably heard the phrase, “Negotiate from a position of strength.” Strength comes from confidence. Confidence comes from being prepared (doing your homework), reaching the right decision-maker, having the right timing, and knowing what you want out of the negotiation. One of the best things you can do to boost your confidence is to practice (role play) your salary negotiation with someone. Ideally, practice with someone who has negotiation experience — for example, a friend or neighbor who is in sales, or who is a lawyer. This guide will help you with the rest: research, timing, and assessing your strengths so you can justify a higher starting salary or a raise.

According to a 2017 CareerBuilder survey, 53 percent of employers are willing—and expect—to negotiate salaries on initial job offers for entry-level workers, but only 44 percent of workers do, potentially missing out on thousands of dollars. Fifty-two percent of employers say when they first extend a job offer to an employee, they typically offer a lower salary than they’re willing to pay so there is room to negotiate. And 26 percent of those employers say their initial offer is $5,000 or more less than what they’re ultimately willing to pay.

Negotiating a Salary at a New Job

Money may seem like the biggest factor in accepting a job, but it can often cloud your decision-making process. Don’t accept a job that you’re not enthusiastic about simply because the starting salary is a few thousand dollars higher than what you’re currently making. It’s probably more important to find a job that lets you do something you enjoy. Ask yourself whether the position presents a career path with upward movement and long-range income potential.

If you’re getting a job offer—and salary discussions usually don’t happen unless you’re a serious candidate—negotiation is an expected part of the process.

What’s the worst that can happen? You may not get all that you’re asking for. You may only get some—but that’s more than you started with. It’s rare (extremely rare!) that a job offer would be rescinded simply because you asked for more money.

Have a positive attitude about salary negotiations. Negotiation is basically a process that could benefit both parties. Understand your needs and those of the company. It is possible to reach a win/win solution. Don’t be aggressive or demanding when negotiating salary or a raise. Keep your tone friendly and civil.

Negotiating a higher starting offer initially can make a big difference in your pay over the long-term. In addition to getting more cash up front, your annual raises will also be based off a higher starting salary.

Let’s say you accept an offer of $35,000 for an entry-level job and are given annual pay increases of 3 percent. After five years, you’ll be making $39,392. On the other hand, if you negotiate a starting pay of $38,500 (a 10 percent increase), after five years, your pay will be $43,331.

The individual who started at $35,000 made $185,819 during those five years; the person who negotiated a starting salary of $38,500 made $204,399—a difference of $18,580.

| Starting Salary of $35,000 | Starting Salary of $38,500 | |

| Year One | $35,000 | $38,500 |

| Year Two | $36,050 (+ $1,050) | $39,655 (+ $1,155) |

| Year Three | $37,132 (+ $2,132) | $40,844 (+ $2,344) |

| Year Four | $38,245 (+ $3,245) | $42,069 (+ $3,569) |

| Year Five | $39,392 (+ $4,392) | $43,331 (+ $4,831) |

The difference is even more pronounced if you add up the five-year total.

| Starting Salary of $35,000 | Starting Salary of $38,500 | |

| Year One | $35,000 | $38,500 |

| Year Two | + $36,050 = $71,050 | + $39,655 = $78,155 |

| Year Three | + $37,132 = $108,182 | + $40,844 = $118,999 |

| Year Four | + $38,245 = $146,427 | + $42,069 = $161,068 |

| Year Five | + $39,392 = $185,819 | + $43,331 = $204,399 |

That $3,500 initial difference grows to $18,580 over the course of five years.

Remember that CareerBuilder research that said that one-fourth of employers surveyed offer $5,000 (or more) less than what they’re ultimately willing to pay as a first offer? That’s less than the 10 percent difference in this example. But even that small amount can make a big difference over the course of several years.

Do Your Homework

When you’re buying any major item (house, car, big screen television), it’s important to do your homework and find out the value of the item. It’s also important to do your homework when negotiating a salary or a raise.

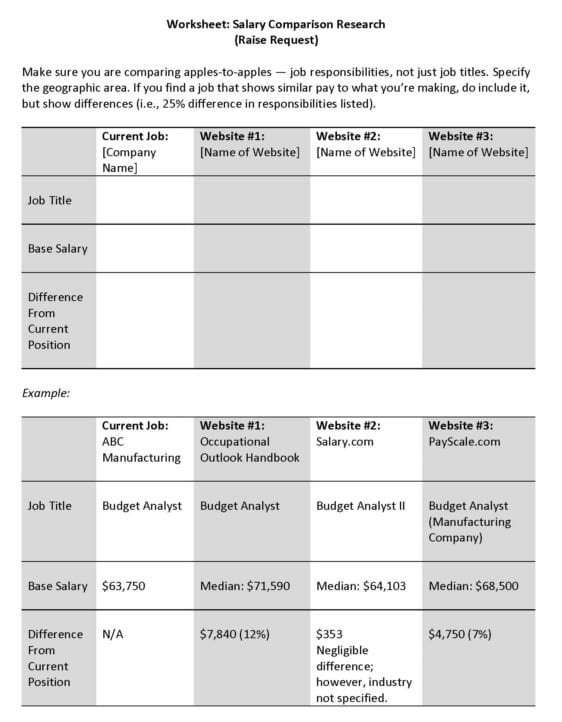

Research your market value—what you’re worth—for your position, level of experience, and industry. In addition to online salary sites, you can get information from your professional or trade association.

Research the prospective employer and its salary structure. If possible, talk to current or former employees. Alumni of your college or university who hold similar positions or who are employed by the same company may provide you with useful information. (LinkedIn can be a good source of contacts for this.)

One of the easiest ways to find out salary information is online. There are websites that offer solid salary information, including:

Bureau of Labor Statistics (wage data by area and occupation)

Occupational Outlook Handbook (click on a specific job and look at the “Pay” section)

CareerOneStop Salary and Benefits Information

U.S. Office of Personnel Management Salaries & Wages (federal salary information)

Salary.com (offers free data and personalized salary reports for a fee)

PayScale.com (requires you to contribute data in order to receive information)

Glassdoor.com (requires you to contribute data in order to receive information)

SalaryExpert.com (input your information and it creates a salary report)

JobStar Salary Surveys (site can be hard to navigate, but offers links to industry-specific salary surveys)

National Association of College and Employers (annual summary of employment outlook and starting salaries for new graduates)

Robert Half International Salary Guides (accounting, finance, financial services, technology, legal, creative positions, administrative jobs)

Indeed.com also offers salary information in general and for specific businesses and organizations on their Company Pages:

You can also do a Google search for “average salary for (job title).” This can sometimes lead you to more specific salary data for a profession.

When using sites like Payscale.com and Salary.com, compare job responsibilities, not job titles. A job title can mean different things at different companies.

If you are relocating, part of your research should include cost-of-living adjustments. You can use the CNN Money Calculator to assess differences between cities.

It can also help to understand what a prospective employer considers when offering a salary. The employer may evaluate:

- the level of the job within the organization

- the scarcity of the skills and experience needed for the job in the job market

- the career progression and experience of the individual selected

- the fair market value of the job you are filling

- the salary range for the job within your organization

- the salary range for the job within your geographic area

- the existing economic conditions within your job market

- the existing economic conditions within your industry

- company-specific factors that might affect the given salary, such as comparative jobs, company culture, pay philosophy, and promotion practices.

How to Handle a Request for Salary on Application Forms

You may be asked salary information on an application form—or be faced with a “current salary” or “desired salary” field on an online application. The answer you provide may be used in the screening process—answer too high and you may not be considered for the position at all. This number will also likely come into play at the interview/offer stage—it can establish the range for the offer the company makes.

On a paper application form—or if the online form allows you to type in whatever you want—you can write “Negotiable.” This gives you the opportunity to discuss your salary history and expectations later.

If it’s not a required field on an online form, leave it blank. If the “desired salary” field requires you to enter a figure, however, you have a couple of options:

- Enter $0, $1, or $10 (the minimum number you can)—it will be clear you’re not answering the questions (most employers will know you aren’t offering to work for free).

- Enter $999,999 (or the highest number you can). Like answering $0, this shows you are purposely avoiding the question.

- If you can, enter a range—some online forms will allow you to enter two numbers.

- You can enter your desired salary—but know that it may lead to you being screened out (if it’s too high), or being offered a lower salary in the interview (if it’s too low).

Timing the Salary Discussion in an Interview

Timing is critical in salary negotiations. In negotiating an initial salary for a job, you (the job seeker) do not want to be the one to bring it up in an interview. Let the hiring manager be the first to discuss salary.

Don’t bring up money until the interviewer brings up money, if you can help it. Remember, they want you to accept the job. The company has put a lot of time and effort into finding the right candidate—you!

If you name a number first, you could be offering a figure below the range the company is prepared to offer—losing money in the process. You could also take yourself out of contention if what you’re asking for is higher than what the company can offer.

The issue of money will likely come up in the interview when the company is serious about you as a candidate. Don’t negotiate salary or benefits until you’ve been offered the job. You certainly do not want to price yourself out of the running, nor do you want to settle for less than you are worth. Employers often have a salary range available for positions, leaving them room to negotiate.

At some point, you will likely be asked for your salary history—or what you were paid in your current / most recent position—so they can make an offer close to your current compensation. The company may ask for your salary history so that they can be sure they’re not wasting time on people who they can’t afford to hire. Do not be deceptive about your current salary. Employers can verify your compensation when conducting reference checks or they may ask you to provide a W-2 form from your current or previous job. Dishonesty, especially if discovered after an offer is made, may be cause for the offer to be rescinded.

However, to prevent employers from basing future salary on your past earnings, some states have enacted a salary history ban. As of 2021, states and territories that have enacted a salary history ban include:

- Alabama

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Georgia

- Hawaii

- Illinois

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Mississippi

- Missouri

- New Jersey

- New York

- North Carolina

- Ohio

- Oregon

- Pennsylvania

- Puerto Rico

- South Carolina

- Utah

- Vermont

- Washington

- Wisconsin

The exact nature of each jurisdiction’s salary ban varies. An overview of the salary ban laws can be found here.

For example, in California, the California Labor Code Section 432.3, which went into effect January 1, 2018, prohibits public and private employers from seeking or relying upon the salary history of applicants. That means employers can’t ask for an applicant’s pay history. If they already have the information, or if the applicant volunteers it, that information cannot be used to determine pay. Employers are also required to provide pay scale information if an applicant asks. An amendment to the original law was passed in July 2018 that clarified some of the terms used in the original law. For example, an applicant may request a salary or hourly wage range for the position after the applicant has completed the initial interview. The amendment also clarified that employers may ask about an applicant’s salary expectations for the role.

How to Respond When Asked for Your Salary Requirements

If asked for your salary requirements, first ask for the pay range for the position. Then, you can respond with, “That’s in the range I was expecting. Once I better understand the requirements of the position and the value I can bring to the company, we can discuss the specific compensation.”

Don’t tip your hand. If the interviewer asks you to supply a dollar amount that would satisfy you, don’t give a concrete number for which you’re willing to settle. You don’t want to take yourself out of the running by naming a figure that is absurdly optimistic, and you don’t want to risk naming a figure that is lower than what the company is ready to offer. Instead of naming a price, say something like, “Based on my experience and skills, and the demands of the position, I’d expect to earn an appropriate figure. Can you give me some idea what kind of range you have in mind?”

If you’re pressed about your desired salary and you feel you must name a figure, give a salary range instead of your most recent salary. And don’t forget to add, “That doesn’t include the value of insurance or other benefits.” The bottom of your salary range should be the minimum you’re willing to accept. The top of the range will be dictated by your salary research and your unique qualifications.

Naming a salary range gives you a chance to find a figure that is also in the range the company has in mind. In fact, many companies base their offers on sliding salary scales.

Here are a few strategies for success when an interviewer asks about your compensation requirements:

- “What was the compensation package for the individual previously in this position?” and then base your answer on that information;

- “What range did you have in mind?” where your answer is always that the high end of the range is what you were considering; or

- “What are you willing to pay an individual in this position with this level of responsibility?” and use that information to answer the question.

Suppose you have given one of the above answers and your interviewer responds with little or no information. He/she again inquires as to your compensation requirements. You must now respond with specific information such as (1) “My requirements are in the $50,000 to $70,000 range”; or (2) “My compensation in my last position was $65,000 and I am seeking to increase that by a minimum of 10%”; or (3) “I am interested in a compensation package including salary, equity interest, and stock options that will total approximately $80,000.”

The more information you can get from the interviewer, the more educated and appropriate your response can be.

Know What You Want

You don’t have to accept the first salary offer you’re given.

Jack Chapman, author of Negotiating Your Salary: How to Make $1000 a Minute suggests responding with a “Hmmm” instead of “Okay” when presented with a salary offer. (“Okay” constitutes acceptance; “Hmmm” gives you room to negotiate.)

You can also ask if the company’s offer is flexible. The “worst-case scenario” might be that the interviewer tells you your salary is set by company policy and there is no room to negotiate.

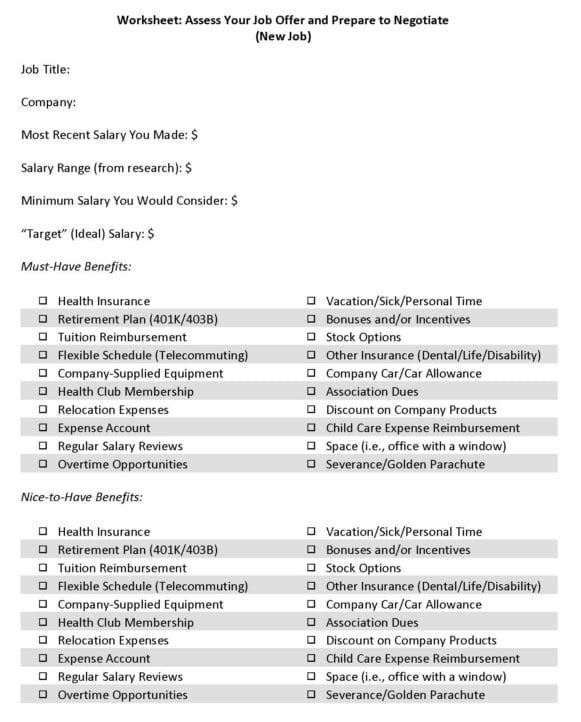

You should also consider the full value of the compensation package—not just the salary.

Benefits can make a huge difference in your compensation package, so don’t overlook them! Perhaps the most important benefit to consider is health insurance. If the company pays only a percentage of these costs, make certain that you can afford to pay the difference out of your own pocket.

Non-cash benefits can add 30 to 40 percent to your total compensation package.

Other benefits and negotiable items may include:

- Health insurance

- Vacation and sick/personal time

- Retirement plans

- Bonuses and/or incentives (including a signing bonus and profit-sharing plans)

- Tuition reimbursement

- Stock options

- Flexible schedule (telecommuting)

- Other insurance (dental, life, accidental death, disability insurance)

- Company-supplied equipment (laptop, cell phone)

- Company car (or car allowance or other transportation expenses)

- Health club membership

- Association dues

- Relocation expenses

- Discount on company products

- Expense account

- Child care expense reimbursement

- Salary reviews (negotiating more frequent reviews and/or raises based on merit or performance vs. cost-of-living)

- Space (i.e., an office with a window, or possibly work-at-home or remote arrangements)

- Overtime policies (if it’s available, and you want to work it, to increase your pay)

- Severance package

Know what is most important to you. When asked if they’d like more money or a non-cash option like flexible scheduling or time off work, many employees will choose the extra time. If that appeals to you, keep that in mind when negotiating.

In your current position, if a raise isn’t available, ask about a bonus instead. Or ask for a non-cash benefit—maybe an extra vacation day, or flexibility in your work schedule (like being able to leave early on Fridays). Or you may want to come in early to the office but leave earlier in the afternoon. Maybe they’ll let you telecommute (work from home) one day a week.

Consider alternative compensation packages. Work is not just about a paycheck. If you are willing to invest your energy, talent, and expertise in a company, don’t you want something more than a paycheck?

You may also ask for additional responsibility—for example, a chance to lead projects or a task force. This gives you the opportunity to position yourself for a raise in the future, as higher-level responsibilities merit higher pay.

Remember, the point of your job search is finding a job that you will be happy with, that you’ll grow with, and that will allow you to be yourself. If your salary isn’t the one you dreamed about, but the job offers opportunity for learning and/or growth, think about the possibility of taking the position with the goal of making yourself invaluable to the organization . . . or positioning yourself for your next job search.

On the other hand, if what the company offers isn’t what you need, you don’t have to take the job. There are other opportunities out there.

The most important thing to remember about salary negotiations is that most salaries are negotiable. That doesn’t mean you name a figure and the company either match it or not. It means you’re ready to listen to what the interviewer has to offer and give it consideration. Just remember to have realistic expectations and realize that you may not get everything you want.

Evaluating the Offer

Once you have a better idea of the salary and non-cash compensation being offered, you can consider the offer.

Here are some things to think about:

- How much do you need to make? How much do you want to make? What is the lowest salary you’d be willing to accept? What is your salary goal?

- Besides money, does this job fulfill any of your other needs—such as schedule flexibility, the opportunity to learn new skills, or the chance to do interesting work?

- What kind of opportunities does the position offer for training, further education, and/or professional advancement?

- Do you have other job prospects lined up? How do they compare to this position?

- What makes you worth a higher salary? How do you compare to the other job candidates? Do you have special skills that are hard to come by?

To determine your fair market value for a specific job, you should consider the economic, geographic, and industry factors of the job offer.

It’s okay to ask for time to consider an offer—24 hours, or the opportunity to “sleep on it”—is common.

Accepting the Offer

When accepting a job offer, get it in writing. Accept the offer verbally, but request a written offer (either a formal letter of agreement or an employment contract).

- Clarify the specific duties and responsibilities.

- Know how your performance will be reviewed, evaluated, and compensated.

- Outline the full compensation package (not just the salary).

Follow up with a thank-you letter that reiterates the job title, annual salary, and your start date.

Making the Case for a Raise

You’re not entitled to a raise—but, at the same time, you deserve to be fairly compensated for your work. If you deserve a raise, ask for one.

Find out how raises are typically handled in your company. Are they given out at a specific time each year? Are they merit-based, or performance-based, or fixed cost-of-living raises?

If you work for a company that doesn’t do annual performance reviews (and raises), ask your supervisor for an opportunity to meet one-on-one to discuss your workload, performance, objectives, and compensation. For each of these topics, you need to take the initiative to prepare the questions and information to guide the discussion. Scheduling regular reviews with your supervisor will help ensure you’re on track with your performance—and give you the opportunity to discuss your performance—and compensation—each year.

Don’t use personal—or emotional—reasons for requesting a raise. Don’t say why you need the money. Your boss likely can’t justify a raise because your basement needs work or you need a new car. “Because you need the money” is never a good reason to ask for a raise. (At least, it’s not a good reason to give to your manager!) What seems to be a legitimate need in your mind might not be for your boss. Keep the focus on your work performance.

Timing Your Raise Request

When seeking a raise, there are certain times of the year when it’s best to request a salary review. This may vary by company, but—in general—it’s a good idea to time your request to coincide with when annual budgets are developed and/or just before when annual performance reviews are conducted.

Don’t wait until your review to approach the issue of a raise; often it will have been decided by the time the performance evaluation is conducted. Prepare your raise request four to six weeks before the appraisal period.

A good time to approach your boss for a raise is when you’ve had a major accomplishment (such as bringing in new business, or finishing a key project), when you’ve taken on significant additional responsibilities, or when you’ve earned recognition for your work.

One key issue of timing is knowing where your company is financially. If they just lost a huge customer—or sales weren’t what they expected in the most recent quarter—this may not be the best time to ask for a raise.

Another bad time to approach your boss for a raise is when he or she is busy or is getting ready to go on a trip or vacation.

Don’t ask for a raise just because a couple other people you work with got raises. Because “everyone else” got a raise doesn’t mean you will too. And don’t compare your salary with other company employees.

Be sure to schedule a time to talk with your boss about the issue of a raise. Send an email or make a personal request (on the phone or in person) for a meeting to discuss your performance.

If your request for a raise is turned down, realize that the reason may not be directly related to your performance. Sometimes the timing just isn’t right. “No” now isn’t “no” forever. If the answer to your request for a raise is no, ask what you can be doing to position yourself for a salary increase in the future. See if you can schedule a time to revisit the topic in the future (say, three or six months), and ask for objectives and/or milestones to reach in the meantime.

Prepare Supporting Documentation

When asking for a raise, provide written materials to back up your salary request. This can include salary data from websites, previous performance evaluations, letters of recommendation, and job postings for similar positions.

If you haven’t been keeping a “brag file,” now is the time to start. Keep a journal of your work accomplishments, letters of commendation from your boss, testimonial letters from customers, and awards. Identify what makes you different (and/or “irreplaceable”) from other candidates or employees.

When asking for a raise, prepare a one- to five-page document outlining what you’ve accomplished (including testimonials, either from other employees or excerpted from performance reports or project status updates) and your salary research.

Make a list of your work achievements and quantify the value to the company (in terms of numbers, percentages, and dollar figures). This provides concrete data for why you’re valuable to the company. Be prepared (with examples) of projects you’ve completed that generated revenue, or saved the company money, or solved a specific problem. Focus on what you’ve done to create positive changes in the company, manage unruly employees or customers, build relationships (internally and externally), and avert disaster. You need to justify your raise.

Also, highlight what you’re working on right now (especially the impact these efforts will have on the company in the near future). Outline your goals for the next year—what are your priorities and what will they contribute to the company?

When you negotiate with a busy person, make it easy for them. If you come in with a fully fleshed-out document supporting your raise, you make it easy for them to say yes. Approach your preparation with this thought in mind: If I were receiving this information, what would make me want to say yes to the request?

Consider using a free service like Get Raised to help you develop your case for your raise. It will help you articulate your value to the company, and it creates a letter that you can submit as a raise request.

Finish the Negotiation

Whether negotiating an initial salary or a raise, be aware of when the negotiation is done. Pushing further when a deal has been set can leave a negative impression.

Find out How This Job Seeker Beat the Applicant Tracking System and Landed a Chief Executive Role with a 20% Salary Bump here. Also, check out How This VP Landed His Dream Job with a 30% Salary Increase and Paid Relocation.

If you are wondering if you should include salary requirements on your Cover Letter, Resume, or Application when asked, read this article here. Here’s more on Addressing Salary Requirements in a Cover Letter.

I would love to connect and continue the conversation on Linkedin. You can send me an invite here.

Share this post:

About the author

Jessica Hernandez, President, CEO & Founder of Great Resumes Fast

Hi, I’m Jessica. I started this company back in 2008 after more than a decade directing hiring practices at Fortune 500 companies.

What started as a side hustle (before that was even a word!) helping friends of friends with their resumes has now grown into a company that serves hundreds of happy clients a year. But the personal touch? I’ve kept that.

You might have seen me featured as a resume expert in publications like Forbes, Fast Company, and Fortune. And in 2020, I was honored to be named as a LinkedIn Top Voice of the year!

I’m so glad you’re here, and I can’t wait to help you find your next perfect-fit position!

Improve Your Resume: Download Your Free Executive Resume Template Today

Are you struggling to create an executive resume that will impress employers? Download this free executive resume template and receive a series of 10 emails with expert guidance on how to write resume content that resonates with employers so you get more interviews.

It's everything you need to stand out, make an impression, and accelerate your job search.